VAPPs Are Reshaping Retirement: Why Zenith Is the Partner You Need

Variable Annuity Pension Plans (VAPPs) are continuing their momentum as organizations seek better alternatives for managing their retirement benefits. At Zenith American Solutions, we are proud to be a national leader in VAPP strategy and administration, helping clients navigate the complexities of this innovative plan design with confidence.

What Is a VAPP?

A VAPP, at its core, is a Defined Benefit (DB) Plan with the key difference being that benefits may adjust annually based on the Plan’s investment performance. Unlike traditional DB plans, which provide fixed benefits (once earned), VAPPs introduce flexibility; benefits can increase or decrease depending on the plan’s assets performance relative to a target performance (known as the Plan’s Hurdle Rate).

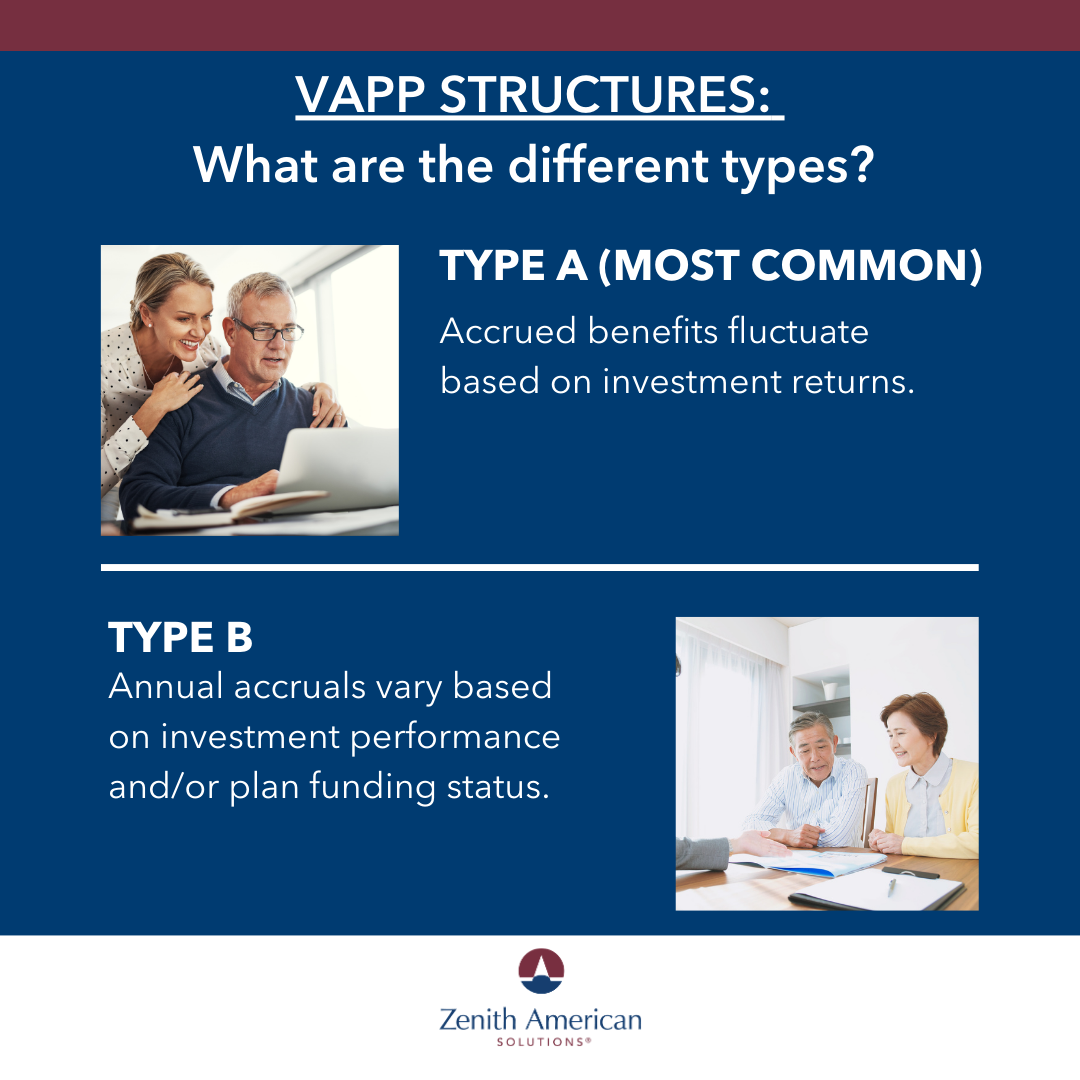

There are two typical VAPP designs:

The most common is where benefits already earned can vary:

Benefits are earned as in a traditional DB Plan, however, once earned all VAPP benefits fluctuate based on investment returns (compared to the plan’s Hurdle Rate).Benefit earned reflect Plan’s funded status: Under this VAPP design, the actual annual benefit accrual formula varies based on investment performance and/or the plan’s funded status.

For background, the majority of plans Zenith has been involved with use the first approach. Also, while it would be possible to combine both approaches, we’ve not seen such in practice.

Why VAPPs Are Gaining Popularity

VAPPs offer an enticing blend of features:

Cost effective lifetime income: For participants/retirees, the plan continues to offer a very cost-effective lifetime income guarantee. This can result in benefits that are 30% to 40% higher than “buying” lifetime income from an insurance company.

Professional asset management: As with a traditional DB plan, the VAPP assets are managed as a large pooled fund (rather than individual accounts). Multiple studies have shown that this arrangement typically out earns participant managed retirement accounts by 50 to 100 basis points per year. Over 30 years this results in an increased value in assets of 15% to 35%.

Reduced cost volatility for employers: One of the biggest concerns for employers with a traditional DB plan is the potential for significant cost volatility. Looking at a simple example, a plan with $95M in assets and $100M in liabilities is funded 95%. If the assets decline 5% (to $90.5M), the plan’s shortfall grows by 90% (from $5M to $9.5M). However, if the liability is also adjusted down by 5%, the result is a liability of $95.2M. Consequently, the funded status remains 95% and the shortfall actual declines from $5M to $4.7M. For employers, this has two positive results of (a) lowering future cost volatility and (b) minimizing the risk of a large future withdrawal liability.

Inflation-responsive benefits: Assuming the Hurdle Rate (target return rate) is set lower than the expected return rate (which is generally the case), there is an expectation that benefits will (in general) increase over time rather than decrease. For retirees, this can feel like a “cost of living” increase during favorable market years.

A more sustainable plan during Market uncertainty. When compared to a traditional DB plan, a VAPP design offers a more sustainable approach to providing lifetime retirement income, particularly in periods of heightened market volatility. Traditional DB plans can face significant risk when investment returns fall below expected ranges. These outlier periods often create funding challenges that may require additional contributions, benefit reductions and/or other plan changes. A VAPP includes a built-in mechanism that automatically adjusts benefits in response to market performance. This flexibility serves as a “relief valve,” helping the plan remain stable and well-funded over time while still providing participants with a secure lifetime pension. Therefore, a VAPP design helps maintain the plan’s financial health through all phases of the market cycle and in turn reduces long-term risk for contributing employers. This stability, in turn, provides greater long term security for current and future retirees.

However, VAPPs also come with important considerations:

Retirees (and beneficiaries) may see reduced benefits in poor market years.

For plans converting from a traditional DB plan to a VAPP, the VAPP feature only applies to future benefits and not benefit already earned. Therefore, prior underfunding remains and still must be managed.

Funding costs can still vary due to actuarial gains and/or losses from all non-investment experience.

Legal implications: In Thole v. U.S. Bank, the Supreme Court ruled that participants in traditional DB plans lacked standing if their benefits are not impacted by Trustee investment decisions. In contrast, VAPP participant benefits are directly affected by investment decisions, potentially increasing fiduciary liability.

While there are good features in a VAPP (as noted above), the design is not a panacea. It is helpful for Trustees to keep in mind that the fundamental equation of all retirement plans still holds. That is, a plan’s benefits and expenses are supported only by the combination of contributions and earnings on those contributions. Therefore, if the contributions, investment strategy and expenses do not change, the plan cannot pay out higher benefits. For this reason, we are seeing more recent DB conversions that include a reduction in the annual accrual on the expectation that favorable VAPP adjustments will make-up for the reduction. This expectation is tied to setting a Hurdle Rate that is well below the plan’s expected future returns.

How VAPPs Work

Each plan sets a Hurdle Rate (e.g., 5.00%). Annual investment returns are compared to this rate:

If returns exceed the Hurdle Rate, benefits increase.

If returns fall short, benefits decrease.

Examples of the Calculations:

Positive Return: 9.00% vs. 6.00% Hurdle Rate → Adjustment Factor = 1.0283

$1,000.00 becomes $1,028.30

The 1.0283 was determined as 1.09 divided by 1.06

Low Return: 4.00% vs. 5.50% Hurdle Rate→ Adjustment Factor = 0.9858

$1,000.00 becomes $985.80

The 0.9858 was determined as 1.040 divided by 1.055

Negative Return: minus 3.00% vs. 5.00% Hurdle Rate → Adjustment Factor = 0.9238

$1,000.00 becomes $923.80

The 0.9238 was determined as .97 divided by 1.05

Needless to say, Trustees are concerned with underperforming years and the impact that may have on retirees and other participants. To that end, we

have seen a few ways to mitigate this result with the two most common being:

Cap recognized earnings and “bank” excess returns for future use. For example, cap favorable return at 9.00%. Therefore, a strong return of, say, 16.00% would result in 9.00% used for increases, while the remaining 7.00% would be “stored” to potentially use for a down year. Use multi-year average returns for the adjustment rather than just one year. This aligns with a common actuarial valuation practice of using an actuarial average asset rather than the current Market Value. For example, a three-year return of 11.00%, 9.00% and minus 2.00% for a plan with a 5.00% Hurdle Rate would result in a favorable return rate of 6.00% for determining the VAPP adjustment rather than using the current negative 2.00% return.

“Defined Benefit plans remain the most cost-effective way to provide high quality retirement benefits. Adding a VAPP feature should allow these plans to remain the retirement cornerstone for Unions while addressing concerns Employers have”

Operational Excellence at Zenith

Implementing a VAPP requires precision. Zenith supports clients with:

Deep VAPP understanding and experience

On-staff actuarial expertise

Staff training and participant education

Custom statements and benefit forms

Annual testing and system updates

Participant-by-participant adjustment tracking

Support for increased call volumes and inquiries

Why Zenith?

Led by Steven Mendelsohn, EA, FCA, MAAA, MSPA, Zenith’s retirement team brings unmatched expertise. Steven’s background includes:

Leadership roles at MassMutual, AON Hewitt, and Retirement System Group

Multiemployer committee service with the American Academy of Actuaries

Frequent speaker at national union and public sector conferences

Let’s Build the Future of Retirement Together

Whether you are exploring a plan conversion or launching a new VAPP, Zenith is your trusted partner. We’ll work with you and your other plan professionals to help guide you through every step, from strategy to implementation to ongoing support.